2.5 Million+ (98.4%)

Population without access to clean cooking (Source: WB, 2023)

10+

Active clean cooking ventures (Source: CCA)

2

Number of clean cooking RBFs (Source: CCA)

Click “Read More” for a detailed overview

The clean cooking sector in The Gambia has seen significant progress in recent years, transitioning from small-scale pilots to large national programs. About 125,000 clean cookstoves are being distributed through initiatives like the Live Well Programme, which is implemented by DelAgua in partnership with the government. These high-efficiency rocket stoves (e.g., Burn stoves from Kenya) reduce wood consumption by up to 70% and significantly lower indoor air pollution (Kenya Ministry of Energy). Earlier pilot projects using improved biomass cookstoves showed promising results, including a 52% reduction in fuelwood use, 40–60% reduction in PM₂.₅ exposure, and 70% less time spent collecting firewood (Kenya Ministry of Energy).

The most common clean cooking solutions in The Gambia include improved biomass cookstoves, rocket stoves, and locally produced clay stoves. These technologies are being promoted by NGOs like CREATE! and Future for Farato, which train women to build and distribute affordable cookstoves using local materials. The Gambian Government, in collaboration with the West Africa Clean Cooking Alliance (WACCA) and the Alliance for Sustainable Cooking Energy in The Gambia (ASCEG), has taken active steps to institutionalize support for clean cooking. These include undertaking national baseline studies, stakeholder coordination, public education campaigns, and policy development.

Despite this progress, challenges such as limited financing options, cultural resistance, and inconsistent stove quality persist. The government and partners are addressing these through subsidies, training programs, and integrating clean cooking into broader energy and health strategies. The sector holds strong potential for growth, particularly with increased investment in local manufacturing, carbon financing, and user behavior change initiatives.

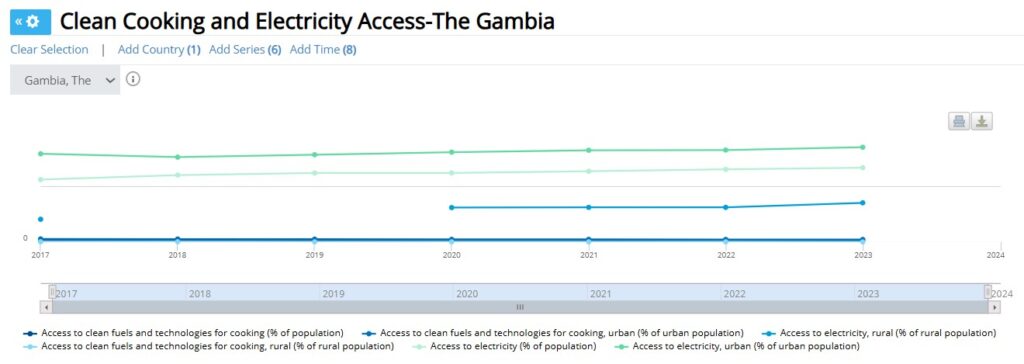

According to World Bank data, 1.6% of the population had access to clean fuels and technologies for cooking in 2023, a 0.1% decline from 2022. In 2023, 2.3% of the urban population had access to clean cooking fuels, compared with just 0.1% of the rural population.

Compared with access to clean cooking fuels and technologies, there is better access to electricity in The GAMBIA; 66.9% of the population had access in 2023, high from 65.4% in 2022.

The disparity between urban and rural areas is stark, highlighting a severe rural energy poverty gap, with rural communities almost entirely dependent on traditional biomass like firewood and charcoal.

Click ‘Read more’ to explore relevant aspects of Gambia’s Nationally Determined Contribution and other policies relevant to clean cooking.

Nationally Determined Contributions

The Gambia’s Nationally Determined Contributions (NDC) under the Paris Agreement acknowledge the importance of clean cooking within the broader context of climate mitigation and energy transition. While clean cooking is not explicitly detailed with standalone targets, it is indirectly integrated through several thematic areas. First, the NDC emphasizes the promotion of renewable energy and energy efficiency, aiming to increase the renewable energy share to 55% by 2030 and to double energy efficiency gains. This directly supports the adoption of clean and energy-efficient cooking technologies such as improved biomass stoves, electric cooking appliances, and solar cookers.

In addition, the NDC addresses household bioenergy consumption and its contribution to deforestation. Woodfuel use—primarily firewood and charcoal for cooking—is identified as a major driver of forest degradation. Therefore, promoting clean cooking solutions is essential for achieving the country’s forest conservation target of maintaining at least 30% forest cover. The NDC also highlights opportunities in waste-to-energy, particularly the generation of biogas from organic waste and wastewater, which aligns with promoting biogas digesters for clean cooking at household and institutional levels.

Furthermore, The Gambia’s NDC Implementation Plan (2021–2030) prioritizes the energy sector and outlines integrated actions across energy, waste, and agriculture. Although it does not include specific quantitative targets for clean cooking, it offers a framework through which such interventions can be monitored and scaled. Institutional efforts led by the Ministry of Environment, Climate Change, and Natural Resources support these strategies, aiming to coordinate and track progress in climate mitigation, including cleaner energy solutions for households.Tax rate (dutiable vs.

Overall, clean cooking remains a critical, though underemphasized, component of The Gambia’s climate agenda. Strengthening its visibility within the NDC framework—by including specific targets for cookstove adoption or alternative fuel deployment—could enhance access to climate finance and improve health, gender equality, and environmental outcomes in line with the country’s sustainable development goals.

| Source | The Gambia NDCs-2021 |

Tax and Tariff Data

This table shows Gambian Duty and VAT for clean cooking items, as of 2025:

| Regional Trade Areas | Official designation | HS Code | Tax or tariff | Duty paid |

| ECOWAS | Electricity | HS 2716 | MFN Import Duty | 5.00% |

| ECOWAS | Electricity | HS 2716 | VAT | 15% |

| ECOWAS | Electricity | HS 2716 | Other taxes and tariffs | 2.75% |

| ECOWAS | Undenatured ethyl alcohol of an alcoholic strength by volume of 80 % vol or higher | HS 2207.10 | MFN Import Duty | 20.00% |

| ECOWAS | Undenatured ethyl alcohol of an alcoholic strength by volume of 80 % vol or higher | HS 2207.10 | VAT | 15% |

| ECOWAS | Undenatured ethyl alcohol of an alcoholic strength by volume of 80 % vol or higher | HS 2207.10 | Other taxes and tariffs | 2.75% |

| ECOWAS | Ethyl alcohol and other spirits, denatured, of any strength | HS 2207.20 | MFN Import Duty | 10.00% |

| ECOWAS | Ethyl alcohol and other spirits, denatured, of any strength | HS 2207.20 | VAT | 15% |

| ECOWAS | Ethyl alcohol and other spirits, denatured, of any strength | HS 2207.20 | Other taxes and tariffs | 2.75% |

| ECOWAS | Ethyl alcohol and other spirits, denatured, of any strength | HS 2207.20 | Excise Tax | D175/litre |

| ECOWAS | Kerosene | HS 2710.19.12 | MFN Import Duty | 5.00% |

| ECOWAS | Kerosene | HS 2710.19.12 | VAT | 15.00% |

| ECOWAS | Kerosene | HS 2710.19.12 | Other taxes and tariffs | 2.75% |

| ECOWAS | Propane | HS 2711.12 | MFN Import Duty | 5.00% |

| ECOWAS | Propane | HS 2711.12 | VAT | 15.00% |

| ECOWAS | Propane | HS 2711.12 | Other taxes and tariffs | 2.75% |

| ECOWAS | Butane | HS 2711.13 | MFN Import Duty | 0.00% |

| ECOWAS | Butane | HS 2711.13 | VAT | 15.00% |

| ECOWAS | Butane | HS 2711.13 | Other taxes and tariffs | 2.75% |

| ECOWAS | Petroleum gases and other gaseous hydrocarbons — Liquefied | HS 2711.19.10 | MFN Import Duty | 5.00% |

| ECOWAS | Petroleum gases and other gaseous hydrocarbons — Liquefied | HS 2711.19.10 | VAT | 0.00% |

| ECOWAS | Petroleum gases and other gaseous hydrocarbons — Liquefied | HS 2711.19.10 | Other taxes and tariffs | 2.75% |

| ECOWAS | Fuelwood – Non-coniferous | HS 4401.12 | MFN Import Duty | 5.00% |

| ECOWAS | Fuelwood – Non-coniferous | HS 4401.12 | VAT | 15.00% |

| ECOWAS | Fuelwood – Non-coniferous | HS 4401.12 | Other taxes and tariffs | 2.75% |

| ECOWAS | Wood Pellets | HS 4401.31 | MFN Import Duty | 5.00% |

| ECOWAS | Wood Pellets | HS 4401.31 | VAT | 15.00% |

| ECOWAS | Wood Pellets | HS 4401.31 | Other taxes and tariffs | 2.75% |

| ECOWAS | Wood briquettes | HS 4401.32 | MFN Import Duty | 5.00% |

| ECOWAS | Wood briquettes | HS 4401.32 | VAT | 15.00% |

| ECOWAS | Wood briquettes | HS 4401.32 | Other taxes and tariffs | 2.75% |

| ECOWAS | Sawdust and wood waste and scrap, agglomerated in logs, briquettes, pellets or similar forms – other | HS 4401.39 | MFN Import Duty | 5.00% |

| ECOWAS | Sawdust and wood waste and scrap, agglomerated in logs, briquettes, pellets or similar forms – other | HS 4401.39 | VAT | 15.00% |

| ECOWAS | Sawdust and wood waste and scrap, agglomerated in logs, briquettes, pellets or similar forms – other | HS 4401.39 | Other taxes and tariffs | 2.75% |

| ECOWAS | Charcoal, other wood | HS 4402.90 | MFN Import Duty | 5.00% |

| ECOWAS | Charcoal, other wood | HS 4402.90 | VAT | 15.00% |

| ECOWAS | Charcoal, other wood | HS 4402.90 | Other taxes and tariffs | 2.75% |

| ECOWAS | Charcoal, of bamboo | HS 4402.10 | MFN Import Duty | 5.00% |

| ECOWAS | Charcoal, of bamboo | HS 4402.10 | VAT | 7.90% |

| ECOWAS | Charcoal, of bamboo | HS 4402.10 | Other taxes and tariffs | 8.50% |

| ECOWAS | Charcoal, of shell or nut | HS 4402.20 | MFN Import Duty | 5.00% |

| ECOWAS | Charcoal, of shell or nut | HS 4402.20 | VAT | 15.00% |

| ECOWAS | Charcoal, of shell or nut | HS 4402.20 | Other taxes and tariffs | 2.75% |

| ECOWAS | Cooking appliances and plate warmers, for gas fuel or gas + other fuels — Presented completely knocked down (CKD) or unassembled for the assembly industry. | HS 7321.11.11 | MFN Import Duty | 10.00% |

| ECOWAS | Cooking appliances and plate warmers, for gas fuel or gas + other fuels — Presented completely knocked down (CKD) or unassembled for the assembly industry. | HS 7321.11.11 | VAT | 8.30% |

| ECOWAS | Cooking appliances and plate warmers, for gas fuel or gas + other fuels — Presented completely knocked down (CKD) or unassembled for the assembly industry. | HS 7321.11.11 | Other taxes and tariffs | 8.50% |

| ECOWAS | Cooking appliances and plate warmers, for liquid fuels — With a maximum of two burners | HS 7321.12.10 | MFN Import Duty | 20.00% |

| ECOWAS | Cooking appliances and plate warmers, for liquid fuels — With a maximum of two burners | HS 7321.12.10 | VAT | 15.00% |

| ECOWAS | Cooking appliances and plate warmers, for liquid fuels — With a maximum of two burners | HS 7321.12.10 | Other taxes and tariffs | 2.75% |

| ECOWAS | Cooking appliances and plate warmers, including for solid fuels | HS 7321.19 | MFN Import Duty | 20.00% |

| ECOWAS | Cooking appliances and plate warmers, including for solid fuels | HS 7321.19 | VAT | 15.00% |

| ECOWAS | Cooking appliances and plate warmers, including for solid fuels | HS 7321.19 | Other taxes and tariffs | 2.75% |

| ECOWAS | Other appliances — for gas or gas+ | HS 7321.81 | MFN Import Duty | 20.00% |

| ECOWAS | Other appliances — for gas or gas+ | HS 7321.81 | VAT | 15.00% |

| ECOWAS | Other appliances — for gas or gas+ | HS 7321.81 | Other taxes and tariffs | 2.75% |

| ECOWAS | Other appliances — for liquid fuels | HS 7321.82 | MFN Import Duty | 20.00% |

| ECOWAS | Other appliances — for liquid fuels | HS 7321.82 | VAT | 15.00% |

| ECOWAS | Other appliances — for liquid fuels | HS 7321.82 | Other taxes and tariffs | 2.75% |

| ECOWAS | Other appliances — for solid fuels | HS 7321.89 | MFN Import Duty | 20.00% |

| ECOWAS | Other appliances — for solid fuels | HS 7321.89 | VAT | 15.00% |

| ECOWAS | Other appliances — for solid fuels | HS 7321.89 | Other taxes and tariffs | 2.75% |

| ECOWAS | Microwave ovens | HS 8516.50 | MFN Import Duty | 20.00% |

| ECOWAS | Microwave ovens | HS 8516.50 | VAT | 15.00% |

| ECOWAS | Microwave ovens | HS 8516.50 | Other taxes and tariffs | 2.75% |

| ECOWAS | Other ovens; cooking stoves, ranges, cooking plates, boiling rings, grillers and roasters — Presented completely knocked down (CKD) or unassembled for the assembly industry | HS 8516.60.10 | MFN Import Duty | 20.00% |

| ECOWAS | Other ovens; cooking stoves, ranges, cooking plates, boiling rings, grillers and roasters — Presented completely knocked down (CKD) or unassembled for the assembly industry | HS 8516.60.10 | VAT | 15.00% |

| ECOWAS | Other ovens; cooking stoves, ranges, cooking plates, boiling rings, grillers and roasters — Presented completely knocked down (CKD) or unassembled for the assembly industry | HS 8516.60.10 | Other taxes and tariffs | 2.75% |

SOURCES:

| Data Source | Link to Source |

| World Trade Organization | https://ttd.wto.org/en/data/idb/applied-duties?member=C270 |

| Commercial Guide-International Trade Administration | Gambia, The – Import Tariffs |

The Gambia has 2 registered cookstove projects. These projects have generated 0.16 million carbon credits to date.

Click ‘Read more’ to explore the dashboard.

- Total Credits Issued: 167,575

- Total Credits Retired: 0

- Number of Projects: 2 (0 GS+ 2 VCS)

- Count of Project Developers: 2

Source: Voluntary Registry Offsets Database (Berkeley Carbon Trading Project)

| Name | Lead | Status | Dates | Applicable Fuels | Fund size for clean cooking | Total fund size | Comments |

| West Africa Clean Cooking Fund | Clean Cooking Alliance | Active | 2022-Present | LPG | $1 million | $1 million | This is a regional initiative, with The Gambia included |

| Clean Cooking for Africa (OPEC Fund/GLPGO) | OPEC Fund+Global LPG Partnership | Completed | 2017 (Pilot) | LPG | Not Specified | $1.5 million (est.) | This is a regional initiative, with The Gambia included |

Connect With Us

If you’d like to see more data on this page, please email carbon@cleancooking.org or fill in the form below.