Overview

The climate crisis will not be solved without clean cooking. Yet this global crisis remains critically underfunded.

Carbon markets are a powerful tool to get more capital flowing in a cost-efficient way, estimated to generate up to $25 billion in capital for clean cooking in the next 25 years. This funding could significantly drive down costs for customers, enabling companies to grow faster and expand into new markets while delivering the widespread benefits of clean cooking.

However, investor uncertainty around the unit economics of clean cooking companies is a binding constraint to investment. Just one-third of enterprises surveyed in CCA’s Industry Snapshot self-reported net profitability in 2020, and seven ventures accounted for more than 90% of investment flows in 2022.

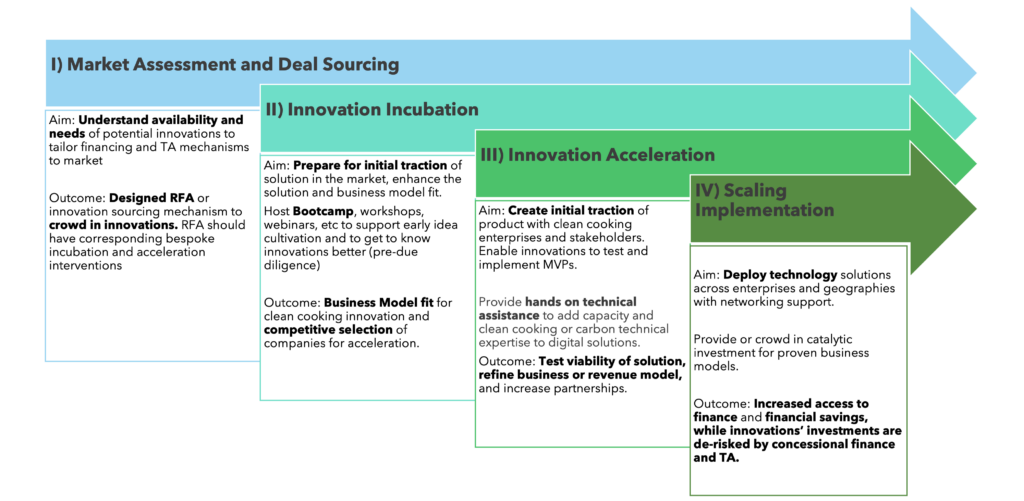

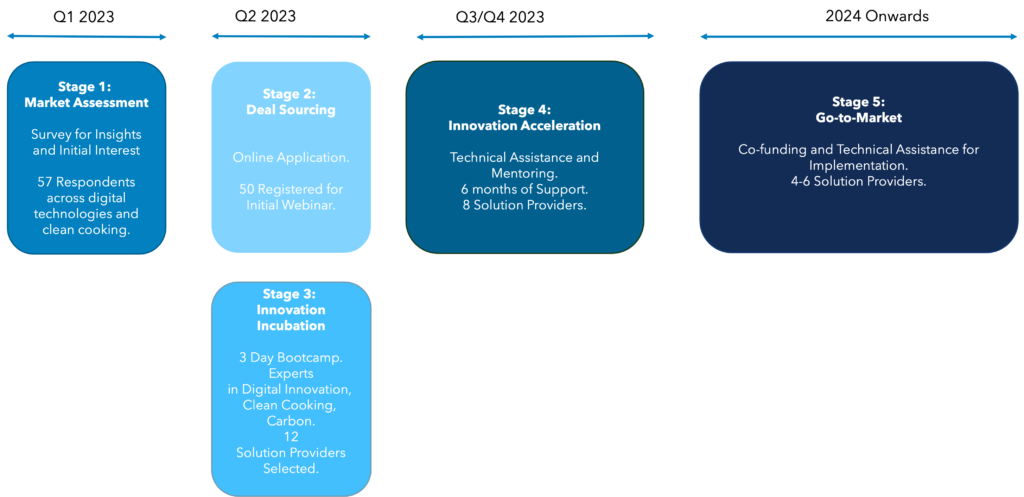

Introducing innovative technologies, business models and processes, and regulations can fundamentally disrupt—and improve—the underlying unit economics in clean cooking companies and projects. Therefore, CCA has partnered with the UN Capital Development Fund (UNCDF) to run Innovation Challenges, which share the risk of investing in an innovation for which the risk-return profile is unknown, and help investors move from a “no-go” to a “go” decision. Innovators are able to field-test their assumptions, collect evidence on the relevant benefits, risks, and unit economics, and feed that information into a business case to secure investment for scaling up.

CCA and UNCDF use a range of instruments, from performance-based grants to technical assistance and brokering, to support private companies in clean cooking and adjacent sectors, as well as public sector regulators. Each Innovation Challenge takes a venture-capital, portfolio-based approach, enabling exceptional ideas to emerge alongside others that do not live up to their initial promise.

Round 1: The Digital Innovation Challenge

The Digital Innovation Challenge invited data companies to develop and test innovations that (1) increase the accuracy and transparency of information on market transactions (e.g,. sales) and customer behavior (e.g., use of cooking technologies); and (2) improve the application of information to reduce costs associated with assessing and de-risking investments and enabling the future monetization of impacts.

The Challenge Process

The Challenge Numbers

The Challenge Winners

| Area of intervention | Project name | Acceleration focus | Geographic focus | |

| Climate Solutions Consulting | Digital solutions to improve data collection and monitoring | Cloud Connected Sensor Ecosystem | Value Proposition (Pilot)

Software Development Pipeline Development |

Kenya, Malawi |

| CarbonHQ | Digital services for carbon finance | Digital Infrastructure for Tomorrow’s Carbon Markets | Value Proposition (Pilot)

Carbon Methodology Alignment Pipeline Development |

Uganda, Rwanda, Kenya, Ethiopia, Nigeria |

| Emerging Cooking Solutions | Digital services for carbon finance | Emerging – the Saas Platform for blockchain native carbon credits based on real-time validation mechanism and IoT data | Buyers Assessment (Premium Credits)

Carbon and Blockchain Regulatory Environment Pipeline Development |

Zambia, Malawi. Mozambique, Kenya, Rwanda |

| Nithio | Digital services for investments/financing | AI-Enabled Financing Platform for Clean Cooking | Clean Cooking Data Landscape (Impact, Business)

Pipeline Development |

Kenya |