100 Million+ (95%)

Population without access to clean cooking (Source: WB, 2023)

23+

Active clean cooking ventures (Source: CCA)

3+

Number of clean cooking RBFs (Source: CCA)

Click “Read More” for a detailed overview

Democratic Republic of Congo (DRC) faces one of the largest clean cooking access challenges in Africa, with over 95% of households relying primarily on biomass fuels such as firewood and charcoal for cooking (CCA). As of 2025, only about 1% of the population regularly uses clean cooking technologies like LPG or electric stoves, making the country’s adoption rate among the lowest globally (Bankable). Approximately 54% of the country’s deforestation is attributed to wood collection for cooking purposes (CCA).

While roughly 12-14% of urban households use improved cookstoves, electric cooking remains limited to about 2.5% of the population, mainly in urban centres (CIFOR). The health and economic consequences of traditional cooking methods are severe; indoor air pollution leads to respiratory illnesses especially among women and children, with related economic losses estimated at $13.6 billion annually, in addition to $16.1 billion in lost productivity linked to wood collection (Bankable). The Gold standard-certified BURN manufacturing project in the DRC has distributed 20,000 efficient cookstoves since 2020, benefitting around 120,000 people (Gold Standard).

Common clean cooking solutions in DRC include improved cookstoves, LPG, electric cooking, and green charcoal or briquettes. LPG use has been growing, particularly in urban areas, with government and private efforts aiming to increase LPG adoption from 14% to over 30% in urban households by 2030 (Bankable). Electricity access remains low (between 9% and 19% nationally), and frequent power interruptions restrict e-cooking scale-up (MECS). Green charcoal and briquettes, made from agricultural residues or sustainable sources, are being piloted to reduce pressure on forests.

The DRC Government is actively promoting clean cooking through several initiatives. Its Energy Compact includes targets to raise clean cooking adoption to 30% by 2030, potentially impacting 40 million people (CCA). A national clean cooking strategy is expected by the end of 2025, emphasizing LPG, improved stoves, and electric cooking (IEA). Fiscal incentives like duty exemptions on clean cooking equipment are being considered to encourage private investment, and partnerships with international organizations such as UNCDF, UNDP, and CAFI provide funding and technical support to local enterprises. Regulatory efforts are underway to draft LPG policies, reform charcoal sectors, and support off-grid electricity development.

Despite this progress, challenges such as underdeveloped infrastructure, electricity reliability issues, high costs, limited household financing options, and nascent policy implementation continue to hinder rapid uptake (IEA). Nonetheless, with growing government commitment and international collaboration, the clean cooking sector in the DRC shows promising momentum to improve health outcomes, reduce deforestation, and promote sustainable energy access.

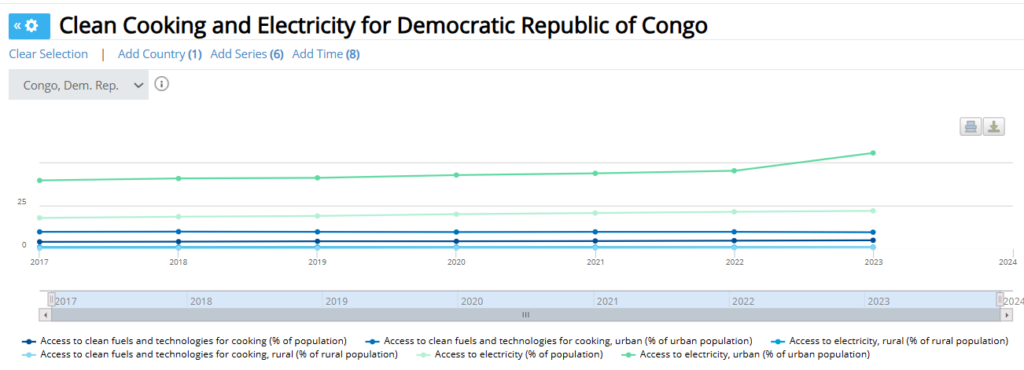

According to World Bank data, 5% of the population had access to clean fuels and technologies for cooking in 2023, a 0.2% increase from 2022. Electrification efforts have had relatively more success in DRC, with 22.1% of the population having access in 2023, up from 21.5% in 2022.

The disparity between urban (9.7%) and rural (0.8%) access to clean cooking underscores the urgent need for inclusive, scalable solutions. Bridging this gap is not only a matter of energy equity but also a critical step toward improving public health, reducing environmental degradation, and empowering communities—especially women and children who bear the brunt of traditional cooking practices. Accelerating investment, innovation, and policy support in clean cooking is essential to ensure that progress in electrification is matched by meaningful strides in sustainable cooking access.

Click ‘Read more’ to explore relevant aspects of DRC’s Nationally Determined Contributions and other current policies that are relevant to clean cooking.

Nationally Determined Contributions

DRC has included clean cooking as a key focus in its updated Nationally Determined Contribution (NDC), submitted in December 2021. The country aims to reduce its greenhouse gas emissions by 21% by 2030—2% through national efforts and 19% dependent on international support. With nearly 69% of the national energy consumption occurring in the residential sector, and 99% of that sourced from traditional biomass like firewood and charcoal, clean cooking is a central mitigation lever in the NDC.

DRC has committed to improving household cooking energy efficiency from the current 12–15% to 25–30% and plans to provide clean cooking solutions to 3 million households by 2030. This includes the promotion of LPG, electric cooking, and improved biomass cookstoves.

Significant investment is required to meet these goals, with estimates indicating the need for about US $234 million annually in public spending and up to US $3.2 billion per year for full-scale access to modern energy cooking services. The government is integrating these goals into a national energy policy that encourages cleaner fuels, better cookstove technology, and expansion of renewable-powered grids.

DRC’s NDC underscores the broader benefits of clean cooking—including improved health, reduced deforestation, gender equality, and climate resilience—and creates a strong foundation for scaling through programs like EnDev, the World Bank’s Clean Cooking Fund, and carbon finance initiatives.

| Source | https://unfccc.int/documents/497407 |

Tax and Tariff Data

This table shows Congolese Duty and VAT for clean cooking items, as of 2025:

| Regional Trade Areas | Official designation | HS Code | Tax or tariff | Quantity |

| COMESA, SADC, EAC | Electricity | HS 2716 | MFN import duty | 10.00% |

| COMESA, SADC, EAC | Electricity | HS 2716 | VAT | Public service/approved investment or industrial projects-0% Private/commercial use-16% |

| COMESA, SADC, EAC | Electricity | HS 2716 | Other taxes and tariffs(Effective consumer price) | Residential-$0.058/kWh Commercial-$0.058/kWh |

| COMESA, SADC, EAC | Undenatured ethyl alcohol of an alcoholic strength by volume of 80 % vol or higher | HS 2207.10 | MFN import duty | 5.00% |

| COMESA, SADC, EAC | Undenatured ethyl alcohol of an alcoholic strength by volume of 80 % vol or higher | HS 2207.10 | VAT | 16% |

| COMESA, SADC, EAC | Undenatured ethyl alcohol of an alcoholic strength by volume of 80 % vol or higher | HS 2207.10 | Exercise duty | 3% |

| COMESA, SADC, EAC | Ethyl alcohol and other spirits, denatured, of any strength | HS 2207.20 | MFN import duty | 0.00% |

| COMESA, SADC, EAC | Ethyl alcohol and other spirits, denatured, of any strength | HS 2207.20 | VAT | 16.00% |

| COMESA, SADC, EAC | Ethyl alcohol and other spirits, denatured, of any strength | HS 2207.20 | Exercise duty | 3% |

| COMESA, SADC, EAC | Ethyl alcohol and other spirits, denatured, of any strength | HS 2207.20 | Other taxes and tariffs | 0.5-4% |

| COMESA, SADC, EAC | Kerosene | HS 2710.19.30 | MFN import duty | 15.00% |

| COMESA, SADC, EAC | Kerosene | HS 2710.19.30 | VAT | 16.00% |

| COMESA, SADC, EAC | Kerosene | HS 2710.19.30 | Exercise duty | 15% |

| COMESA, SADC, EAC | Kerosene | HS 2710.19.30 | Other taxes and tariffs | 0.5-4% |

| COMESA, SADC, EAC | Butane | HS 2711.13 | MFN import duty | 15.00% |

| COMESA, SADC, EAC | Butane | HS 2711.13 | VAT | 16.00% |

| COMESA, SADC, EAC | Butane | HS 2711.13 | Exercise duty | 15% |

| COMESA, SADC, EAC | Butane | HS 2711.13 | Other taxes and tariffs | 0.5-4% |

| COMESA, SADC, EAC | Propane | HS 2711.12 | MFN import duty | 15.00% |

| COMESA, SADC, EAC | Propane | HS 2711.12 | VAT | 16.00% |

| COMESA, SADC, EAC | Propane | HS 2711.12 | Exercise duty | 15% |

| COMESA, SADC, EAC | Propane | HS 2711.12 | Other taxes and tariffs | 0.5-4% |

| COMESA, SADC, EAC | Petroleum gases and other gaseous hydrocarbons — Liquefied | HS 2711.19.10 | MFN import duty | 15.00% |

| COMESA, SADC, EAC | Petroleum gases and other gaseous hydrocarbons — Liquefied | HS 2711.19.10 | VAT | 16.00% |

| COMESA, SADC, EAC | Petroleum gases and other gaseous hydrocarbons — Liquefied | HS 2711.19.10 | Exercise duty | 15% |

| COMESA, SADC, EAC | Petroleum gases and other gaseous hydrocarbons — Liquefied | HS 2711.19.10 | Other taxes and tariffs | 0.5-4% |

| COMESA, SADC, EAC | Fuelwood – Non-coniferous | HS 4401.12 | MFN import duty | 5.00% |

| COMESA, SADC, EAC | Fuelwood – Non-coniferous | HS 4401.12 | VAT | 16.00% |

| COMESA, SADC, EAC | Fuelwood – Non-coniferous | HS 4401.12 | Exercise duty | 0% |

| COMESA, SADC, EAC | Fuelwood – Non-coniferous | HS 4401.12 | Other taxes and tariffs | 0.5-4% |

| COMESA, SADC, EAC | Wood Pellets | HS 4401.31 | MFN import duty | 0.00% |

| COMESA, SADC, EAC | Wood Pellets | HS 4401.31 | VAT | 16.00% |

| COMESA, SADC, EAC | Wood Pellets | HS 4401.31 | Exercise duty | 0% |

| COMESA, SADC, EAC | Wood Pellets | HS 4401.31 | Other taxes and tariffs | 0.5-4% |

| COMESA, SADC, EAC | Wood briquettes | HS 4401.32 | MFN import duty | 0.00% |

| COMESA, SADC, EAC | Wood briquettes | HS 4401.32 | VAT | 16.00% |

| COMESA, SADC, EAC | Wood briquettes | HS 4401.32 | Exercise duty | 0% |

| COMESA, SADC, EAC | Wood briquettes | HS 4401.32 | Other taxes and tariffs | 0.5-4% |

| COMESA, SADC, EAC | Sawdust and wood waste and scrap, agglomerated in logs, briquettes, pellets or similar forms – other | HS 4401.39 | MFN import duty | 0.00% |

| COMESA, SADC, EAC | Sawdust and wood waste and scrap, agglomerated in logs, briquettes, pellets or similar forms – other | HS 4401.39 | VAT | 16.00% |

| COMESA, SADC, EAC | Sawdust and wood waste and scrap, agglomerated in logs, briquettes, pellets or similar forms – other | HS 4401.39 | Exercise duty | 0% |

| COMESA, SADC, EAC | Sawdust and wood waste and scrap, agglomerated in logs, briquettes, pellets or similar forms – other | HS 4401.39 | Other taxes and tariffs | 0.5-4% |

| COMESA, SADC, EAC | Charcoal, other wood | HS 4402.90 | MFN import duty | 0.00% |

| COMESA, SADC, EAC | Charcoal, other wood | HS 4402.90 | VAT | 16.00% |

| COMESA, SADC, EAC | Charcoal, other wood | HS 4402.90 | Exercise duty | 0% |

| COMESA, SADC, EAC | Charcoal, other wood | HS 4402.90 | Other taxes and tariffs | 0.5-4% |

| COMESA, SADC, EAC | Charcoal, of bamboo | HS 4402.10 | MFN import duty | 0.00% |

| COMESA, SADC, EAC | Charcoal, of bamboo | HS 4402.10 | VAT | 16.00% |

| COMESA, SADC, EAC | Charcoal, of bamboo | HS 4402.10 | Exercise duty | 0% |

| COMESA, SADC, EAC | Charcoal, of bamboo | HS 4402.10 | Other taxes and tariffs | 0.5-4% |

| COMESA, SADC, EAC | Charcoal, of shell or nut | HS 4402.20 | MFN import duty | 0.00% |

| COMESA, SADC, EAC | Charcoal, of shell or nut | HS 4402.20 | VAT | 16.00% |

| COMESA, SADC, EAC | Charcoal, of shell or nut | HS 4402.20 | Exercise duty | 0% |

| COMESA, SADC, EAC | Charcoal, of shell or nut | HS 4402.20 | Other taxes and tariffs | 0.5-4% |

| COMESA, SADC, EAC | Cooking appliances and plate warmers, for gas fuel or gas + other fuels — Presented completely knocked down (CKD) or unassembled for the assembly industry. | HS 7321.11.11 | MFN import duty | 5.00% |

| COMESA, SADC, EAC | Cooking appliances and plate warmers, for gas fuel or gas + other fuels — Presented completely knocked down (CKD) or unassembled for the assembly industry. | HS 7321.11.11 | VAT | 16.00% |

| COMESA, SADC, EAC | Cooking appliances and plate warmers, for gas fuel or gas + other fuels — Presented completely knocked down (CKD) or unassembled for the assembly industry. | HS 7321.11.11 | Exercise duty | 0% |

| COMESA, SADC, EAC | Cooking appliances and plate warmers, for gas fuel or gas + other fuels — Presented completely knocked down (CKD) or unassembled for the assembly industry. | HS 7321.11.11 | Other taxes and tariffs | 0.5-4% |

| COMESA, SADC, EAC | Cooking appliances and plate warmers, for liquid fuels — With a maximum of two burners | HS 7321.12.10 | MFN import duty | 25.00% |

| COMESA, SADC, EAC | Cooking appliances and plate warmers, for liquid fuels — With a maximum of two burners | HS 7321.12.10 | VAT | 18.00% |

| COMESA, SADC, EAC | Cooking appliances and plate warmers, for liquid fuels — With a maximum of two burners | HS 7321.12.10 | Railway development levy | 1.5% |

| COMESA, SADC, EAC | Cooking appliances and plate warmers, for liquid fuels — With a maximum of two burners | HS 7321.12.10 | Customs processing | 0.6% |

| COMESA, SADC, EAC | Cooking appliances and plate warmers, including for solid fuels | HS 7321.19 | MFN import duty | 35.00% |

| COMESA, SADC, EAC | Cooking appliances and plate warmers, including for solid fuels | HS 7321.19 | VAT | 21.60% |

| COMESA, SADC, EAC | Cooking appliances and plate warmers, including for solid fuels | HS 7321.19 | Exercise duty | 0% |

| COMESA, SADC, EAC | Cooking appliances and plate warmers, including for solid fuels | HS 7321.19 | Other taxes and tariffs | 3.5-5.5% |

| COMESA, SADC, EAC | Other appliances — for gas or gas+ | HS 7321.81 | MFN import duty | 25.50% |

| COMESA, SADC, EAC | Other appliances — for gas or gas+ | HS 7321.81 | VAT | 25.50% |

| COMESA, SADC, EAC | Other appliances — for gas or gas+ | HS 7321.81 | Other taxes and tariffs | 16% |

| COMESA, SADC, EAC | Other appliances — for liquid fuels | HS 7321.82 | MFN import duty | 25.00% |

| COMESA, SADC, EAC | Other appliances — for liquid fuels | HS 7321.82 | VAT | 20.00% |

| COMESA, SADC, EAC | Other appliances — for liquid fuels | HS 7321.82 | Other taxes and tariffs | 5.5% |

| COMESA, SADC, EAC | Other appliances — for solid fuels | HS 7321.89 | MFN import duty | 35.00% |

| COMESA, SADC, EAC | Other appliances — for solid fuels | HS 7321.89 | VAT | 21.60% |

| COMESA, SADC, EAC | Other appliances — for solid fuels | HS 7321.89 | Other taxes and tariffs | 5.5% |

| COMESA, SADC, EAC | Microwave ovens | HS 8516.50.90 | MFN import duty | 10.00% |

| COMESA, SADC, EAC | Microwave ovens | HS 8516.50.90 | VAT | 17.60% |

| COMESA, SADC, EAC | Microwave ovens | HS 8516.50.90 | Other taxes and tariffs | 5.5% |

| COMESA, SADC, EAC | Other ovens; cooking stoves, ranges, cooking plates, boiling rings, grillers and roasters — Presented completely knocked down (CKD) or unassembled for the assembly industry | HS 8516.60.10 | MFN import duty | 5.00% |

| COMESA, SADC, EAC | Other ovens; cooking stoves, ranges, cooking plates, boiling rings, grillers and roasters — Presented completely knocked down (CKD) or unassembled for the assembly industry | HS 8516.60.10 | VAT | 16.00% |

| COMESA, SADC, EAC | Other ovens; cooking stoves, ranges, cooking plates, boiling rings, grillers and roasters — Presented completely knocked down (CKD) or unassembled for the assembly industry | HS 8516.60.10 | Other taxes and tariffs | 0.5-4% |

SOURCES:

| Data Source | Link to Source |

| Congo, the democratic republic of the Country Commercial Guide | Democratic Republic of the Congo – Import Tariffs |

| VAT and other taxes | Congo, Democratic Republic of the – Corporate – Other taxes |

DRC has 25 registered cookstove projects. These projects have generated 1.8 million carbon credits to date.

Click ‘Read more’ to explore more.

- Total Credits Issued: 1,809,713

- Total Credits Retired: 202,987

- Number of Projects: 25 (22 GS + 3 VCS)

- Number of Project Developers: 10

Source: Voluntary Registry Offsets Database (Berkeley Carbon Trading Project)

| Name | Lead | Status | Dates | Applicable Fuels | Fund size for clean cooking | Total fund size |

| Modern Cooking Facility for Africa (MCFA) | Nefco(Nordic Env’t Finance Corp), SEforALL | Active | Phase 1 (2022-2024) Phase 2 (2024-2027) |

LPG, Electric cooking, Biogas | €18M+ across 7 countries | €45M+ |

| TDB_BURN ASCENT Platform Clean Cooking Deployment | TDB Group(Via TDF), BURN, World Bank | Active | 2024-2027(est.) | Biomass stoves, Induction/electric cooking | Not disaggregated | $12M+ blended finance package |

| ACTIF/UNCDF Clean Cooking Credit Facility via MFIs | UNCDF, UNDP, CAFI | Active | 2022-2025 (pilot scaling) | LPG kits, improved biomass stoves (via micro-loans) | $500+ leveraged via MFIs | Part of ACTIF $5M+ |

Connect With Us

If you’d like to see more data on this page, please email carbon@cleancooking.org or fill in the form below.