1 Million+ (46.2%)

Population without access to clean cooking (Source: WB, 2023)

8+

Active clean cooking ventures (Source: CCA)

3+

Number of clean cooking RBFs (Source: CCA)

Click “Read More” for a detailed overview

Lesotho’s clean cooking sector is making gradual progress, though significant challenges remain. As of 2023, only 53.8% of the population had access to clean cooking fuels and technologies (World Bank), with most households still relying on traditional biomass like wood and charcoal. This contributes heavily to indoor air pollution, respiratory diseases, deforestation, and greenhouse gas emissions, 63% of which come from the energy sector (SNV).

Common clean cooking solutions in the country include solar-biomass hybrid stoves, electric pressure cookers (EPCs), and biogas systems. A standout local innovation is the ACE One stove, produced by African Clean Energy (ACE), which reduces fuel use by up to 70% and smoke emissions by 95%, while also providing lighting and phone charging(SNV). ACE operates through local energy hubs with a pay-as-you-go model, reaching off-grid communities and supporting women-led enterprises. In 2022, the World Food Programme also piloted EPCs in schools in Lesotho, showing significant cost savings and faster, cleaner cooking, with potential for national scale-up.

The Government of Lesotho, in partnership with organizations like UNIDO and the Green Climate Fund, is working to support private-sector involvement and improve access to climate finance. However, local efforts remain constrained by policy and fiscal barriers, including high import taxes and limited government incentives. For the sector to expand, there is a pressing need for stronger national policies, removal of financial bottlenecks, and enhanced support for innovation and rural distribution. Scaling successful pilot projects, creating enabling regulatory frameworks, and investing in local enterprises will be key to achieving widespread access to clean cooking across the country.

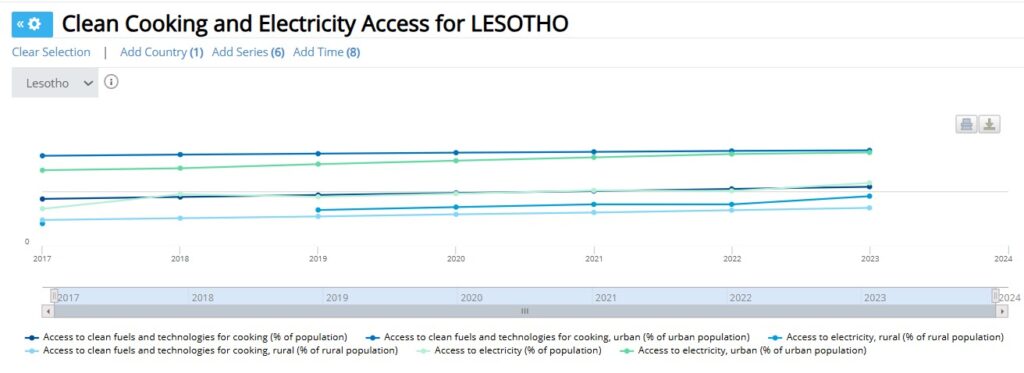

According to World Bank data, 53.8% of the population had access to clean fuels and technologies for cooking in 2023, an improvement of 2% compared to the previous year. In 2023, 86.9% of the urban population had access to clean cooking fuels, compared with just 34.5% of the rural population.

Access to electricity in Lesotho is relatively higher: 57.3% of the population had access in 2023, compared to 50% in 2022.

Click ‘Read more’ to explore relevant aspects of Lesotho’s Nationally Determined Contribution and other policies relevant to clean cooking.

Nationally Determined Contributions

Lesotho’s Nationally Determined Contribution (NDC) under the Paris Agreement outlines several clear commitments related to clean cooking and household energy, aimed at reducing greenhouse gas emissions and improving public health. The country aims to achieve 30% penetration of efficient cookstoves by 2030, alongside a plan to reduce fuelwood use for heating to just 10% of total fuel consumption. To accelerate this transition, Lesotho aims to replace 10% of fuelwood use with LPG annually between 2020 and 2030. The NDC also promotes the installation of biogas digesters in rural households to produce clean cooking gas as a sustainable alternative to traditional fuels.

These clean cooking goals are integrated into Lesotho’s broader climate and energy strategy. The country aims to improve energy efficiency by 20%, increase household electricity access from 35% in 2015 to 50% by 2030, and expand renewable energy capacity by 200 MW, including wind, solar, and hydropower. Lesotho’s Second NDC (2024–2030) reaffirms energy-sector mitigation as a top priority, signaling a sustained commitment to clean energy access and climate resilience. Together, these targets reflect a national effort to reduce reliance on biomass, improve air quality, and align with global climate goals through sustainable energy solutions.

| Source | Lesotho NDC |

Tax and Tariff Data

This table shows Lesotho Duty and VAT for clean cooking items, as of 2025:

| Regional Trade Area | Official designation | HS Code | Tax or tariff | Tax rate (dutiable vs. duty paid) |

| SACU, SADC | Electricity | HS 2716 | MFN import duty | 0.00% |

| SACU, SADC | Electricity | HS 2716 | VAT | 10% |

| SACU, SADC | Electricity | HS 2716 | Other taxes and tariffs (Electrification) | Household-Lsl 0.02 per kWh Industrial-Lsl 0.03 per kWh |

| SACU, SADC | Undenatured ethyl alcohol of an alcoholic strength by volume of 80 % vol or higher | HS 2207.10 | MFN import duty | 317c/li aa |

| SACU, SADC | Undenatured ethyl alcohol of an alcoholic strength by volume of 80 % vol or higher | HS 2207.10 | VAT | 15% |

| SACU, SADC | Undenatured ethyl alcohol of an alcoholic strength by volume of 80 % vol or higher | HS 2207.10 | Excise duty | Lsl 77.67/Ltr |

| SACU, SADC | Ethyl alcohol and other spirits, denatured, of any strength | HS 2207.20 | MFN import duty | 317c/li aa |

| SACU, SADC | Ethyl alcohol and other spirits, denatured, of any strength | HS 2207.20 | VAT | 15% |

| SACU, SADC | Ethyl alcohol and other spirits, denatured, of any strength | HS 2207.20 | Excise duty | Lsl 77.67/Ltr |

| SACU, SADC | Kerosene | HS 2710.19.15 | MFN import duty | 0% |

| SACU, SADC | Kerosene | HS 2710.19.15 | VAT | 0.00% |

| SACU, SADC | Kerosene | HS 2710.19.15 | Other taxes and tariffs | Exempt |

| SACU, SADC | Propane | HS 2711.12 | MFN import duty | 0% |

| SACU, SADC | Propane | HS 2711.12 | VAT | 0.00% |

| SACU, SADC | Propane | HS 2711.12 | Other taxes and tariffs | Exempt |

| SACU, SADC | Butane | HS 2711.13.90 | MFN import duty | 0% |

| SACU, SADC | Butane | HS 2711.13.90 | VAT | 0.00% |

| SACU, SADC | Butane | HS 2711.13.90 | Other taxes and tariffs | Exempt |

| SACU, SADC | Petroleum gases and other gaseous hydrocarbons — Liquefied | HS 2711.19.10 | MFN import duty | 0% |

| SACU, SADC | Petroleum gases and other gaseous hydrocarbons — Liquefied | HS 2711.19.10 | VAT | 0.00% |

| SACU, SADC | Petroleum gases and other gaseous hydrocarbons — Liquefied | HS 2711.19.10 | Other taxes and tariffs | Exempt |

| SACU, SADC | Fuelwood – Non-coniferous | HS 4401.12 | MFN import duty | 0% |

| SACU, SADC | Fuelwood – Non-coniferous | HS 4401.12 | VAT | 15% |

| SACU, SADC | Fuelwood – Non-coniferous | HS 4401.12 | Other taxes and tariffs | None |

| SACU, SADC | Wood Pellets | HS 4401.31 | MFN import duty | 0% |

| SACU, SADC | Wood Pellets | HS 4401.31 | VAT | 15% |

| SACU, SADC | Wood Pellets | HS 4401.31 | Other taxes and tariffs | None |

| SACU, SADC | Wood briquettes | HS 4401.32 | MFN import duty | 0% |

| SACU, SADC | Wood briquettes | HS 4401.32 | VAT | 10% |

| SACU, SADC | Wood briquettes | HS 4401.32 | Other taxes and tariffs | None |

| SACU, SADC | Sawdust and wood waste and scrap, agglomerated in logs, briquettes, pellets or similar forms – other | HS 4401.39 | MFN import duty | 0% |

| SACU, SADC | Sawdust and wood waste and scrap, agglomerated in logs, briquettes, pellets or similar forms – other | HS 4401.39 | VAT | 10% |

| SACU, SADC | Sawdust and wood waste and scrap, agglomerated in logs, briquettes, pellets or similar forms – other | HS 4401.39 | Other taxes and tariffs | None |

| SACU, SADC | Charcoal, other wood | HS 4402.90 | MFN import duty | 0% |

| SACU, SADC | Charcoal, other wood | HS 4402.90 | VAT | 10% |

| SACU, SADC | Charcoal, other wood | HS 4402.90 | Other taxes and tariffs | None |

| SACU, SADC | Charcoal, of bamboo | HS 4402.10 | MFN import duty | 0% |

| SACU, SADC | Charcoal, of bamboo | HS 4402.10 | VAT | 10% |

| SACU, SADC | Charcoal, of bamboo | HS 4402.10 | Other taxes and tariffs | None |

| SACU, SADC | Charcoal, of shell or nut | HS 4402.20 | MFN import duty | 0% |

| SACU, SADC | Charcoal, of shell or nut | HS 4402.20 | VAT | 10% |

| SACU, SADC | Charcoal, of shell or nut | HS 4402.20 | Other taxes and tariffs | None |

| SACU, SADC | Cooking appliances and plate warmers, for gas fuel or gas + other fuels — Presented completely knocked down (CKD) or unassembled for the assembly industry. | HS 7321.11.11 | MFN import duty | 0% |

| SACU, SADC | Cooking appliances and plate warmers, for gas fuel or gas + other fuels — Presented completely knocked down (CKD) or unassembled for the assembly industry. | HS 7321.11.11 | VAT | 10% |

| SACU, SADC | Cooking appliances and plate warmers, for gas fuel or gas + other fuels — Presented completely knocked down (CKD) or unassembled for the assembly industry. | HS 7321.11.11 | Other taxes and tariffs | None |

| SACU, SADC | Cooking appliances and plate warmers, for liquid fuels — With a maximum of two burners | HS 7321.12.10 | MFN import duty | 0% |

| SACU, SADC | Cooking appliances and plate warmers, for liquid fuels — With a maximum of two burners | HS 7321.12.10 | VAT | 10% |

| SACU, SADC | Cooking appliances and plate warmers, for liquid fuels — With a maximum of two burners | HS 7321.12.10 | Other taxes and tariffs | None |

| SACU, SADC | Cooking appliances and plate warmers, including for solid fuels | HS 7321.19 | MFN import duty | 0% |

| SACU, SADC | Cooking appliances and plate warmers, including for solid fuels | HS 7321.19 | VAT | 10% |

| SACU, SADC | Cooking appliances and plate warmers, including for solid fuels | HS 7321.19 | Other taxes and tariffs | None |

| SACU, SADC | Other appliances — for gas or gas+ | HS 7321.81 | MFN import duty | 0% |

| SACU, SADC | Other appliances — for gas or gas+ | HS 7321.81 | VAT | 10% |

| SACU, SADC | Other appliances — for gas or gas+ | HS 7321.81 | Other taxes and tariffs | None |

| SACU, SADC | Other appliances — for liquid fuels | HS 7321.82 | MFN import duty | 0% |

| SACU, SADC | Other appliances — for liquid fuels | HS 7321.82 | VAT | 10% |

| SACU, SADC | Other appliances — for liquid fuels | HS 7321.82 | Other taxes and tariffs | None |

| SACU, SADC | Other appliances — for solid fuels | HS 7321.89 | MFN import duty | 0% |

| SACU, SADC | Other appliances — for solid fuels | HS 7321.89 | VAT | 10% |

| SACU, SADC | Other appliances — for solid fuels | HS 7321.89 | Other taxes and tariffs | None |

| SACU, SADC | Microwave ovens | HS 8516.50.90 | MFN import duty | 0% |

| SACU, SADC | Microwave ovens | HS 8516.50.90 | VAT | 10% |

| SACU, SADC | Microwave ovens | HS 8516.50.90 | Other taxes and tariffs | None |

| SACU, SADC | Other ovens; cooking stoves, ranges, cooking plates, boiling rings, grillers and roasters — Presented completely knocked down (CKD) or unassembled for the assembly industry | HS 8516.60.10 | MFN import duty | 0% |

| SACU, SADC | Other ovens; cooking stoves, ranges, cooking plates, boiling rings, grillers and roasters — Presented completely knocked down (CKD) or unassembled for the assembly industry | HS 8516.60.10 | VAT | 10% |

| SACU, SADC | Other ovens; cooking stoves, ranges, cooking plates, boiling rings, grillers and roasters — Presented completely knocked down (CKD) or unassembled for the assembly industry | HS 8516.60.10 | Other taxes and tariffs | None |

SOURCES:

| Data Source | Link to Source |

| World Trade Organization | WTO Tariff & Trade Data | Data / IDB |

| Lesotho Country Commercial Guide | Lesotho – Import Tariffs |

| PWC Tax Summary | Lesotho | VAT in Africa | PwC |

| Guide on Zero-rated supplies of goods | Guide on Zero-rated Supplies of Goods.pdf |

Lesotho has 2 registered cookstove projects. These projects have generated 0.25 million carbon credits to date.

Click ‘Read more’ to explore more.

- Total Credits Issued: 254,272

- Total Credits Retired: 25,316

- Number of Projects: 2 (2 GS + 0 VCS)

- Count of Project Developers: 2

Source: Voluntary Registry Offsets Database (Berkeley Carbon Trading Project)

| Name | Lead | Status | Dates | Applicable Fuels | Fund size for clean cooking | Total fund size |

| ACE RBF via EEP Africa | African Clean Energy/EEP Africa | Completed | 2019-2021 | Solar-biomass hybrid cookstove | €0.5 m | €0.9 m |

| Electric Pressure Cooker Pilot (EPC) | WFP/MECS (UK aid) | Completed | 2023-2024 | Electric cooking | Not specified | Not specified |

Connect With Us

If you’d like to see more data on this page, please email carbon@cleancooking.org or fill in the form below.