Visualizing the Market Opportunity for Clean Cooking in Sub-Saharan Africa

To better understand demand for clean cooking solutions, CCA partnered with Fraym to analyze the current and potential clean cooking market in six African countries. These reports focused on Ghana, Nigeria, Uganda, Rwanda, Kenya, and Ethiopia are being officially launched during CCA’s first-ever Week of Clean Cooking.

To inform market entry strategies for different types of clean cooking products and services, Fraym segmented potential clean cooking consumers into two broad groupings: early-adopters and followers. Early-Adopter households are those with high consumption power, as evidenced by their ownership of high-cost assets, access to electricity, and homes made from high-quality materials.

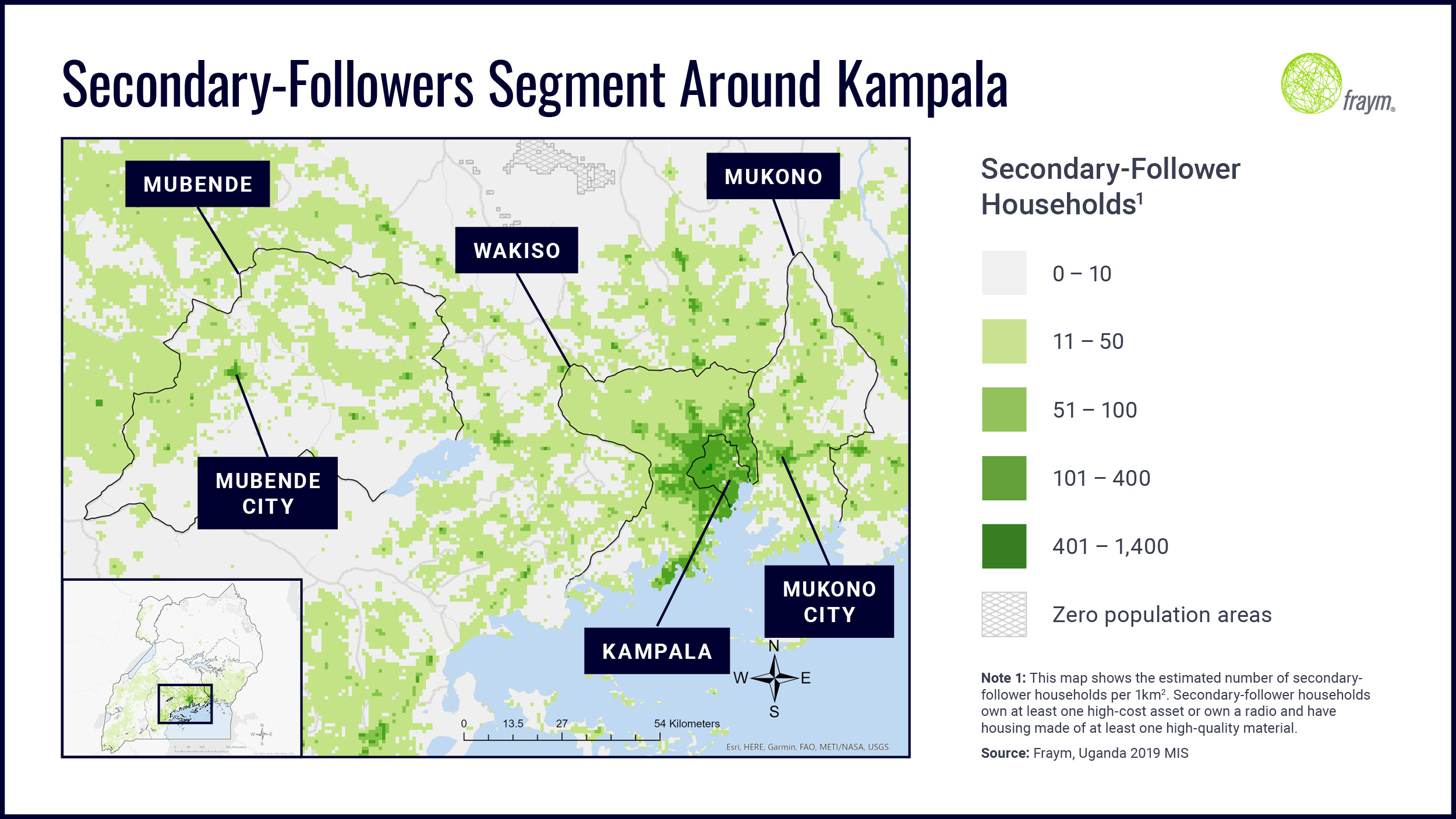

Follower households have moderate consumption power as evidenced by asset ownership, home construction material, and level of financial inclusion. Follower households can be further segmented into fast-followers and secondary-followers. Fast-followers have bank accounts, indicating they may have access to savings and credit to finance the purchase of clean cookstoves. Secondary-followers are lower-middle income consumers that lack access to traditional bank accounts but may still be able to afford lower-cost clean cooking products.

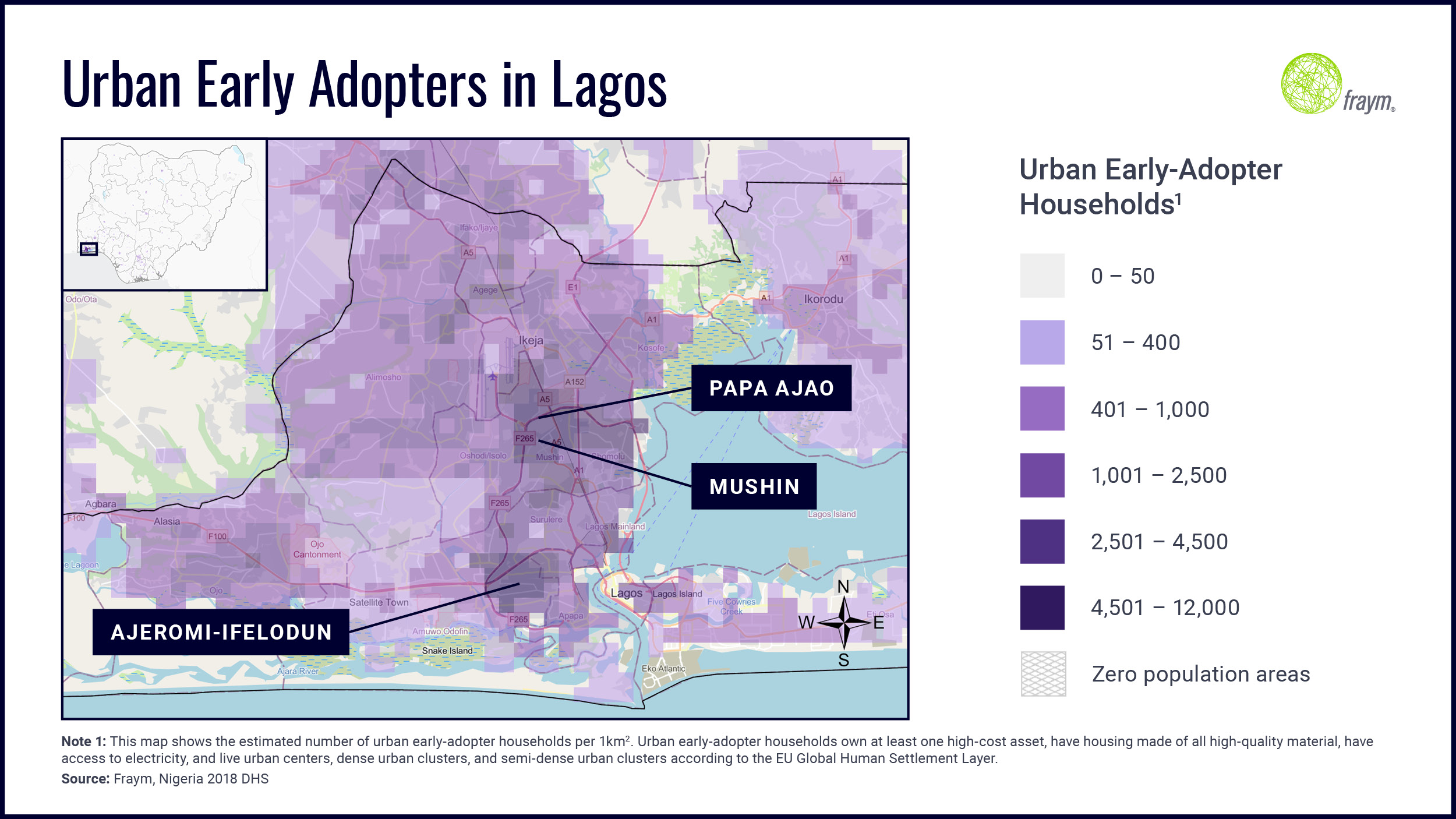

Fraym’s geospatial analysis showed unique market dynamics in each country. For example, Ghana and Nigeria have similar levels of clean cooking fuel adoption, with about one fifth of all households already using a clean cooking fuel. Of the remaining households that use solid cooking fuels, over one quarter are early-adopters. This consumer segment has the highest consumption power and these households are the most likely to adopt a clean cooking technology in the near future. There are around 2.7 million Early-Adopter households in Ghana and over 13 million in Nigeria. In Ghana, these households are concentrated around Kumasi, Accra and the Ashanti region, while in Nigeria there are large pockets of these consumers in Lagos and Abuja as well as throughout Rivers state.

In the consumer segmentation reports, Fraym further divides this group by urban and rural locations to better examine consumer characteristics. Nearly half of all urban early-adopter households in Nigeria use kerosene and spend about $3 per month on this fuel. Strategies focusing on transitioning kerosene-users to clean cooking technologies may be effective at reaching these Nigerian consumers. For example, the Government of Nigeria has announced plans to increase adoption of LPG from the current five percent to 90 percent in the next 10 years to reduce the use of kerosene, firewood, and charcoal. In Ghana, on the other hand, charcoal is the most common solid cooking fuel. Four out of five urban early-adopter households primarily use charcoal for cooking and they spend roughly $8 per month on this fuel.

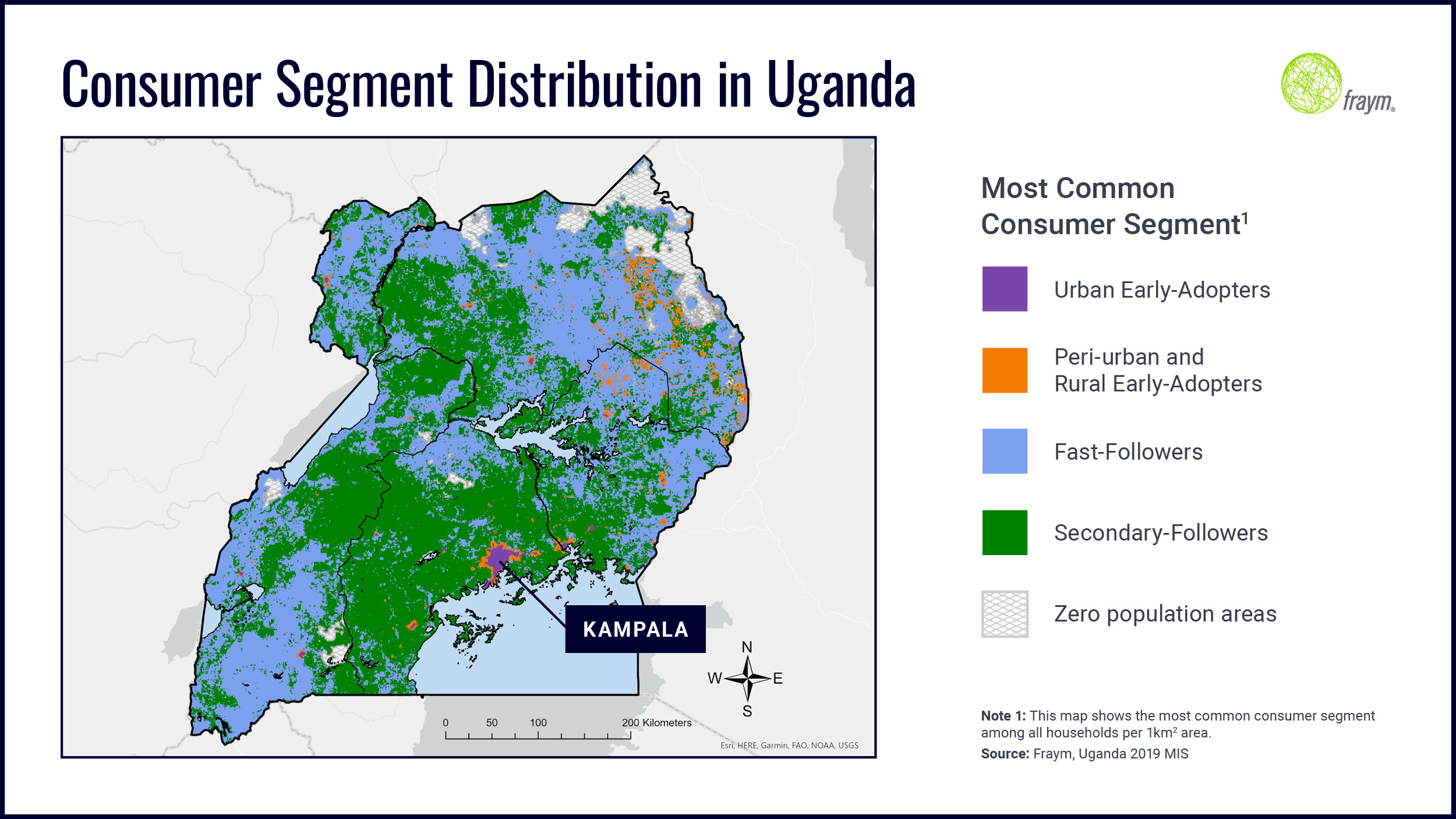

In the neighboring countries of Uganda and Rwanda only about 1 percent of all households use clean cooking fuels. Wood is most commonly used for cooking in rural areas, while charcoal is most common in urban areas. To inform behavior-change campaigns, Fraym analyzed media consumption patterns and identified the most common form of media used by people in both countries to be radio.

Despite these similarities, there are differences in the distribution of consumer segments, especially in rural areas. In rural Rwanda, fast-followers are the most common consumer segment. Financial inclusion is more scattered in rural Uganda. In most rural parts of the Central region, secondary-followers are the most common consumer segment.

Kenya and Ethiopia also differ in their potential for clean cooking adoption. Over 60 percent of households in Ethiopia are neither early-adopter nor follower households due to limited consumption power, compared to nearly 30 percent in Kenya. Kenya also has higher rates of bank account and mobile money access. Financially included fast-followers account for 29 percent of all households in Kenya and mainly reside around the Nairobi and Nakuru counties.

The differences in market characteristics between and within countries highlight the need for targeted market entry strategies. Fraym’s consumer segmentation and sub-national data provides perspective on where populations might be most willing and able to transition to clean cooking technologies. These insights can inform a variety of decisions from the types of products offered to marketing campaigns and policy decisions.

About Fraym

Fraym is the preeminent global provider of geospatial data for understanding population dynamics. Governments and organizations around the world rely on Fraym data to make strategic and operational decisions while tackling challenges like inequity and insecurity, climate vulnerability, public health, and more. The company’s advanced AI/ML models are the first to generate high-resolution insights about human characteristics, behaviors, and attitudes at the sub-neighborhood level and make them commercially available at scale.

About CCA

The Clean Cooking Alliance works with a global network of partners to build an inclusive industry that makes clean cooking accessible to the three billion people who live each day without it. Established in 2010, the Alliance is driving consumer demand, mobilizing investment to build a pipeline of scalable businesses, and fostering an enabling environment that allows the sector to thrive. Clean cooking transforms lives by im- proving health, protecting the climate and the environment, empowering women, and helping families save time and money.